Mandaluyong Report 2017

EXECUTIVE SUMMARY

The city of Mandaluyong remains one of the most prime real estate hotspots in Metro Manila. Its condominium market is also one of Philippine capital’s most buoyant, with demand often outstripping supply.

Being situated at the heart of the National Capital Region, Mandaluyong benefits from the region’s transport infrastructure, most notably the MRT Line 3, EDSA, and other important thoroughfares. In fact, close to MRT Line 3’s two stations in Mandaluyong is most of the city’s condo developments, with the clear intention to tap into the young and mobile condo-buying market.

There are several areas or mixed-use districts in Mandaluyong that clearly take advantage of the city’s transport infrastructure. One is the Boni Avenue–Pioneer Street area, where several multi-tower condo developments have been launched over the last several years.

Another is Greenfield District, which is situated at the corner of EDSA and Shaw Boulevard. This area is now home to several condo developments, BPO offices, and an arcade-type shopping mall.

Furthermore, Mandaluyong holds jurisdiction to the western half of Ortigas Center—Metro Manila’s second most important business district. In this part of Ortigas Center are some of the area’s most esteemed residents, including the headquarters of the Asian Development Bank and San Miguel Corporation. This section is also home to some of the business district’s most upscale condo developments.

While clearly not as prime as Makati, Mandaluyong is one of those places in Metro Manila where condos offer a viable real estate investment, especially with the city’s buoyant economy and good transport infrastructure.

The city of Mandaluyong remains one of the most prime real estate hotspots in Metro Manila. Its condominium market is also one of Philippine capital’s most buoyant, with demand often outstripping supply.

Being situated at the heart of the National Capital Region, Mandaluyong benefits from the region’s transport infrastructure, most notably the MRT Line 3, EDSA, and other important thoroughfares. In fact, close to MRT Line 3’s two stations in Mandaluyong is most of the city’s condo developments, with the clear intention to tap into the young and mobile condo-buying market.

There are several areas or mixed-use districts in Mandaluyong that clearly take advantage of the city’s transport infrastructure. One is the Boni Avenue–Pioneer Street area, where several multi-tower condo developments have been launched over the last several years.

Another is Greenfield District, which is situated at the corner of EDSA and Shaw Boulevard. This area is now home to several condo developments, BPO offices, and an arcade-type shopping mall.

Furthermore, Mandaluyong holds jurisdiction to the western half of Ortigas Center—Metro Manila’s second most important business district. In this part of Ortigas Center are some of the area’s most esteemed residents, including the headquarters of the Asian Development Bank and San Miguel Corporation. This section is also home to some of the business district’s most upscale condo developments.

While clearly not as prime as Makati, Mandaluyong is one of those places in Metro Manila where condos offer a viable real estate investment, especially with the city’s buoyant economy and good transport infrastructure.

REPORT HIGHLIGHTS

SUPPLY

Prices of available units have increased significantly but continue to remain at a mid-level range

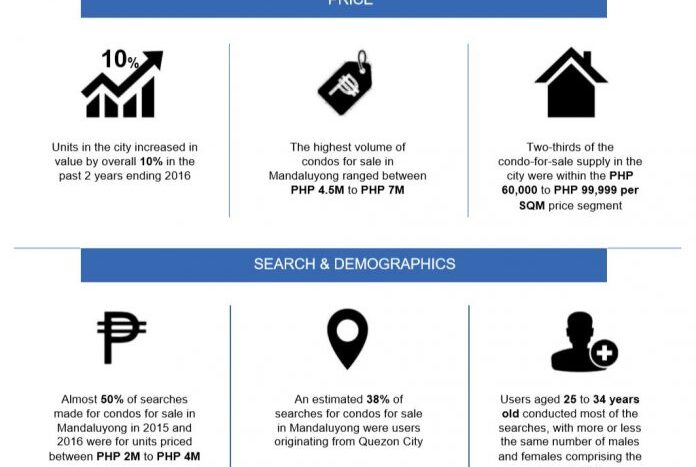

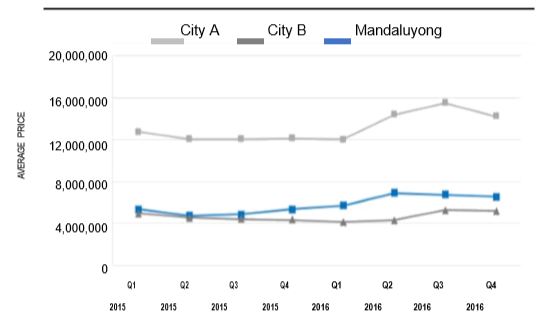

Similar to at least two other cities in Metro Manila, Mandaluyong experienced a constant increase in prices of condominiums for sale in the years 2015 and 2016, starting out at an average of about PHP 5 million, and ending the two-year period of the latter at an average of approximately PHP 7 million.

SQM Distribution Units in Mandaluyong were also kept within a median price range, being no less than PHP 4 million and no more than PHP 8 million in the past two years. The city continues to offer reasonably priced property, at least in comparison to other cities, like City A, which had averages that were no lower than PHP 12 million.

CHANGES IN AVERAGE PRICE

Prices increased overall in two years

After dipping by about 5-percent for most of 2015 and at the start of 2016, the average prices of condos for sale in Mandaluyong peaked with an increase of around 20-percent in the third quarter of 2016, from its initial average at the beginning of 2015. The two-year span concluded with average prices increasing by 10-percent overall.

At least two other cities in Metro Manila experienced a similar fluctuation in prices of condos for sale, despite their differences in averages. For all three cities, most of 2015 saw values becoming slightly lower, but eventually become higher compared to the beginning of the year to by the time 2016 drew to a close.

RELATIVE PRICE EVOLUTION

The supply of lower-priced condo units remains modest in the city

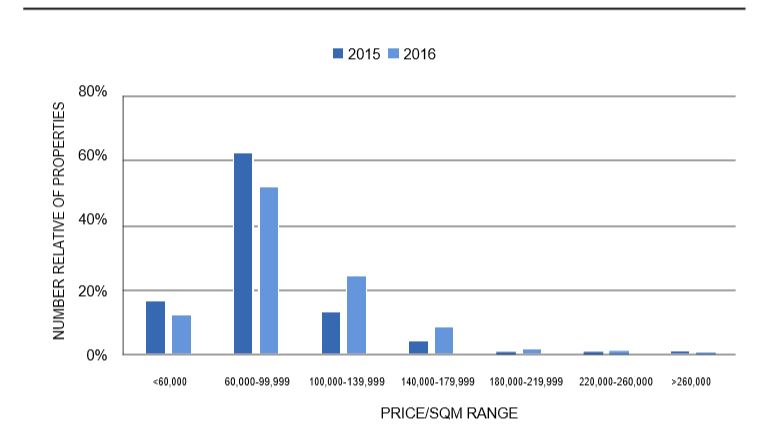

In terms of price per square meter, common in the Mandaluyong condo market are those in the mid-range segment—those that cost between PHP 60,000 and PHP 99,999 per square meter. In 2016, half of the condo units available in Mandaluyong fall under this price range.

Condominium units priced at PHP 60,000 or lower are also available in the city, although similarly, comprised a little less of the total stock of condo space in the city, from approximate 15-percent in 2015, to just about 10-percent in 2016. Units priced between PHP 100,000 to PHP 139,999, on the other hand, became more abundant in the local market in 2016.

PROPERTY PRICE/SQM DISTRIBUTION

DEMAND

Interest in Mandaluyong condos peaked in Q2 2016

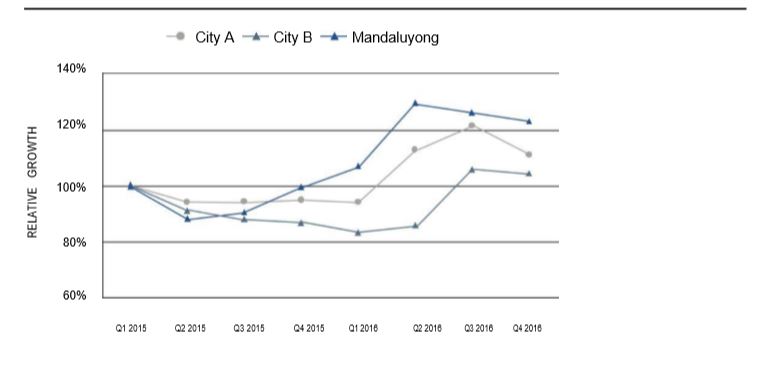

Demand in condos for sale in Mandaluyong has grown in the past two years. It peaked in the second quarter of 2016 when there were almost three times more demand than at the start of 2015. While growth eventually settled down to a more normal level towards the end of the year, a relatively significant amount was still experienced overall, with 50% more inquiries after two years.

It must be noted, however, that while demand for condos for sale in Mandaluyong had indeed become lower towards the end of 2016, the city cannot be singled out for experiencing this trend. As exhibited by Cities A and B, there was indeed a downturn in demand for condos for sale overall in Metro Manila, likely due to the increasing preferences for properties and their associated lower prices, in locations outside the capital. Still, the demand remains high and is much more so than two years prior.

RELATIVE EVOLUTION OF INQUIRIES

DISTRIBUTION OF INQUIRIES OVER PRICE RANGE

There continues to be growing interest in affordable units in Mandaluyong

While it can be argued that condominiums in other cities in Metro Manila may slightly generate more interest from buyers and renters than those in Mandaluyong, interest in real estate in the city can be counted on to be consistent due to the combination of a central location and more competitive prices. Condo seekers continue to have a preference for affordable to mid-priced units, indicative of the city’s reputation as an affordable alternative to the likes of Makati and Taguig.

Units priced from PHP 2 million to just under PHP 4 million comprise the bulk of inquiries for condominiums for sale in Mandaluyong, suggesting that the preference in the city is for midrange units that can either be afforded by mid-senior to senior professionals who want to live in a central location in Metro Manila or purchased by investors who want to lease or sell to the same aforementioned market. Although the inquiries for units within the price range took a slight dip in 2016, it still dominates among condo searches in the city, followed by units priced between PHP 4 million and PHP 6

DEMOGRAPHIC

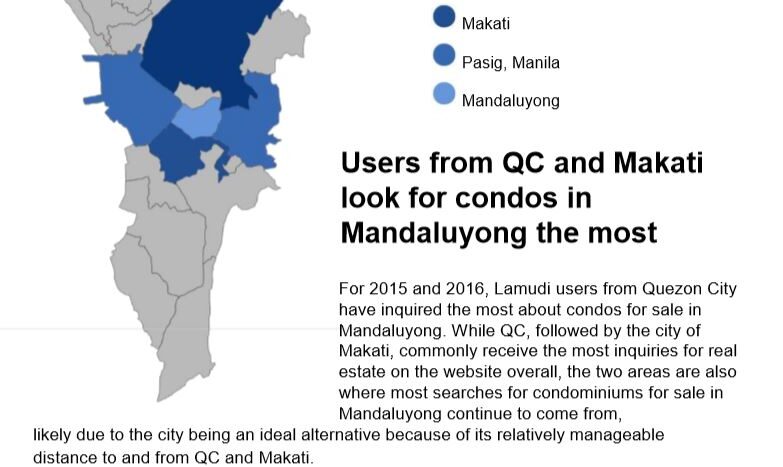

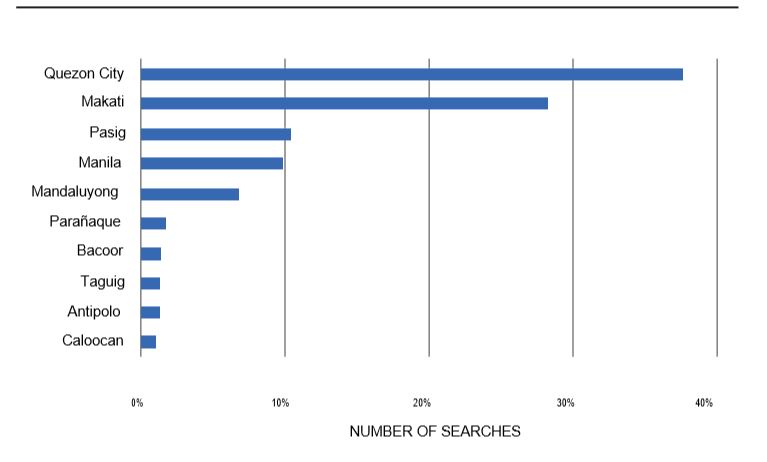

COMMON LOCATION OF PROPERTY SEEKERS

AGES AND GENDER OF PROPERTY SEEKERS

Users in a young to middle working age look for condos in Mandaluyong the most

With regard to who searches most for condos for sale in Mandaluyong, users aged 25 to 34 years old comprise the majority of those looking for units on KB-REALITY followed by users aged 35 to 44. Among the former are almost even composition of male and female users, while for the latter, most searches were done by males in the age group, with only about a third as much by females.

Searches from much older users, those aged between 45 and 64 years old, have been significantly less, and based on KB-REALITY data, are all seemingly conducted by female users. There can be many assumptions which can be taken from this, such as that older men are a little more averse to technology than older women, hence having the latter conducting almost all of the searches, or that there is a greater population of women at an advanced age who search for retirement properties.

CROSS ANALYSIS

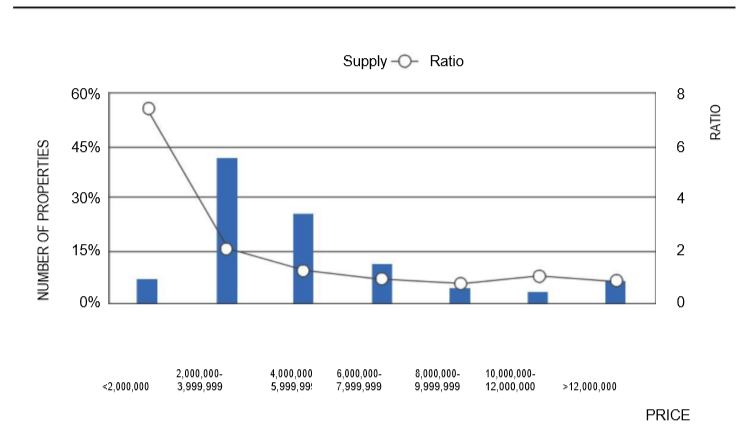

PROPERTY PRICE DISTRIBUTION IN PERCENTAGE, RELATIVE TO ANNUAL VALUE VS DEMAND OVER SUPPLY RATIO

There is significant demand for affordable condos in Mandaluyong that remains unsatisfied by the current supply

Condos valued between PHP 2 million and under PHP 4 million comprise a majority of the market in Mandaluyong, followed by units priced between PHP 4 and PHP 6 million. In terms of the demand relative to the supply of these units, those in the PHP 2-4 million price range receive a modest amount of interest, with at least two parties interested in every unit available. For units priced between PHP 4 and 6 million, there is at least one interested party for every condo listed

While condominiums for sale priced at PHP 2 million or below comprise about a tenth of the total supply in Mandaluyong, it is these units that continue to garner the most interest from buyers searching online, with about 7 of these individuals looking at each property on average. This disparity between the interest in affordable condos and the lack of supply of these units to meet the demand in the city is what investors or developers can look to focus on in terms of determining what future residential projects would be most viable.

Real Estate Developer Refers to Data to Help Decide on Land Use

An established real estate developer which had expanded its land bank in four cities in Metro Manila wanted to get the demand indication in those areas for condominiums, which is the company’s standard price segment product.

While Mandaluyong was on its shortlist for its next residential condominium project, the company was wary of the city has a significant supply, as it has had the fourth most combined preselling and ready-for-occupancy units in Metro Manila between 1992 to the first quarter of 2017 as determined by the Housing and Land Use and Regulatory Board.

The developer’s internal research efforts often require independent data gathering to supplement their overall decision making, and in making considerations for their land in Mandaluyong, they tasked KB-REALITY Philippines to gather more information.

Determining market trends using user data

Through the course of Lamudi’s operations, about 45 percent of listings it has had for condominiums for sale in Mandaluyong were for units priced between PHP 60,000 and PHP 99,999 per square meter, or an estimated PHP 2 million to PHP 4 million per unit.

While spaces in this price range composed most of Mandaluyong’s supply, Lamudi’s user data, however, also indicated that the most significant portion (about 55 percent) of demand for condos in the city came from users interested in spaces costing PHP 2 million or less.

Hence, even if an estimated 11 percent of the preselling and RFO units in Metro Manila have belonged in the city of Mandaluyong, the demand for affordably priced is not being met by this.

Deciding on land use based on the existing market

The addition of Lamudi’s data has helped the developer determine that Mandaluyong is a viable place to invest in real estate projects and that they have the benefit of knowing there is a significant number of potential buyers looking for low-cost condominium units in the city. It is a market that continues to be untapped and one that the real estate developer can proceed to center the use of their land on.

In addition, Lamudi’s search data includes information from where users conduct their search, giving the real estate developer a general idea of where there are the most people looking into their developments and can produce particular marketing campaigns for that location.

Real Estate Developer Narrows Down Location Choices for Land Acquisition

An established real estate developer was looking to acquire property and expand their portfolio of projects and wanted to conduct a study among the different locations on their shortlist to gain a better perspective on the current real estate trends in those areas. They would ultimately use the various reports and data they acquire as a reference to help them decide on where to purchase.

Analysis of 2 years’ worth of online real estate listings data

With that, Lamudi ran a demand and supply analysis, as well as a cross-analysis of the two, using online listings and user data which it had collected for the entirety of 2015 and 2016. The amount of data and the extended period it covered provided both Lamudi and the real estate developer an idea of which property types continue to receive the most views or inquiries from buyers looking online, as well as the price range which garners the most interest from the said users.

One of the cities on the shortlist of the real estate developer was Mandaluyong which, based the listings for condos for sale in the city listed on KB-REALITY between 2015 and

2016, had about 40 percent of its inventory comprised of units priced between PHP 2 million to PHP 4 million. Despite the significant number of options in the said price range however, KB-REALITY also determined that units priced PHP 2 million or below still garnered more interest, with least 7 interested buyers for each one.

Recognizing the viability of one city and an untapped market

Considering that condos priced at PHP 2 million or below comprised just about 5 percent of the units posted for sale on Lamudi in the past two years, it became clear to the real estate developer that the ideal project for Mandaluyong would be one that caters to the very viable market of buyers looking for an affordable condominiums. Also evident was that midpriced condos may no longer be ideal for the city, given the healthy supply of such units, but not enough demand to go around.

With the help of the information they gathered, the real estate developer was able to better understand the viability of investing in Mandaluyong, among the other cities in their shortlist, and realize which areas would rank more than the other in terms of their investment potential and the overall bottom line for their business.