About the Real Estate Industry in the Philippines and its Trends for 2022.

The Real Estate Landscape of the Philippines

In the second quarter of 2021, the real estate industry generated over ₱126 billion in revenue. Its growing middle-class population and consistent remittances from Overseas Filipino Workers (OFWs) make the industry one of the key drivers to the Philippine economy.

As a Result, the country’s constant efforts to ease doing business in the Philippines have allowed foreign enterprises to continue investing in its real estate market. At present, the value of approved real estate activities from foreign direct investments (FDIs) amounts to ₱507 million.

Trends for Commercial Real Estate

The Philippine government is actively boosting the economy through initiatives like Build Build Build and business-friendly regulations, attracting inbound FDIs. Demand for commercial real estate is rising, with Metro Manila CBDs—Taguig, Makati, Pasig, and Quezon City—leading the market. Moreover investors are eyeing regional hubs such as Baguio, Angeles, Cebu City, Davao City, and Cagayan de Oro for growth opportunities. Simultaneously, the rise of hybrid work setups is driving demand for flexible, safe office spaces, making the Philippine real estate sector a dynamic landscape for investment.

IT-Business Process Outsourcing (BPO) Sector as Top Buyer

The IT-BPO sector in the Philippines is predicted to increase its real estate investment in 2022. The country’s BPO sector accounts for 15% of the global BPO market, ranking as one of the top outsourcing hubs in the world.

The influx of FDIs allowed the industry to obtain more and more real estate to cater to their business operations and working spaces their-inhouse employees. According to the Philippine Economic Zone Authority (PEZA), the industry receives an increase of 37% in IT-BPO management pledges from foreign investors.

Nevertheless, despite the ongoing COVID-19 pandemic, PEZA foresees the leasing of condominiums and other properties escalating in the next 18 months as the industry continues to expand.

Growing Popularity of Co-Working Spaces

Recently, the trend of using co-working spaces to conduct meetings, projects, and even business operations has been continuously rising in the Philippines. Due to its flexible and cheaper options, many companies are opting to lease co-working spaces to complement existing headquarters.

According to Colliers Philippines, flexible working spaces are seen to expand by 10% in the next three years. Such spaces allow enterprises to provide a closer option for employees as social distancing and workplace restrictions emerge amid COVID-19.

This enables remote workers, freelancers, and other independent professionals to work together in a communal setting, providing a more efficient and work-life balance-friendly alternative.

FDIs Contributing to Growth of Commercial Real Estate

In 2021, there has been an influx of inbound foreign investments in the Philippines, amounting to ₱36 billion worth of investments from various countries. Notably, according to the Philippine Statistics Authority (PSA), countries such as the United States (US), Taiwan, and Japan have made investment pledges of around ₱13 billion, ₱4.4 billion, and ₱4.3 billion, respectively.

Furthermore, the number of approved FDIs is expected to generate approximately 24,000 jobs, thereby increasing the demand for workplaces to cater to the industrial and commercial needs of enterprises operating in the Philippines. As a result the real estate sector is positioned to support this growing workforce.

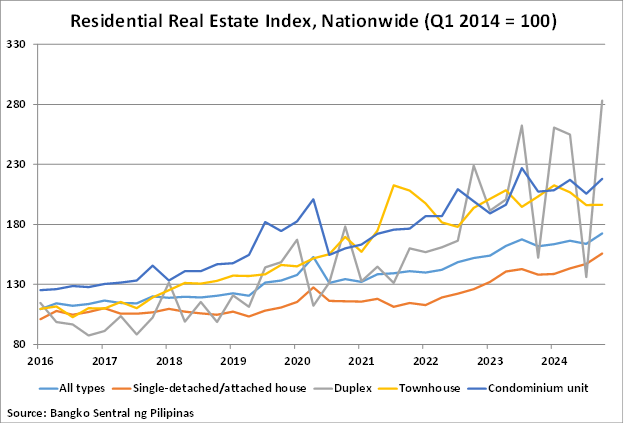

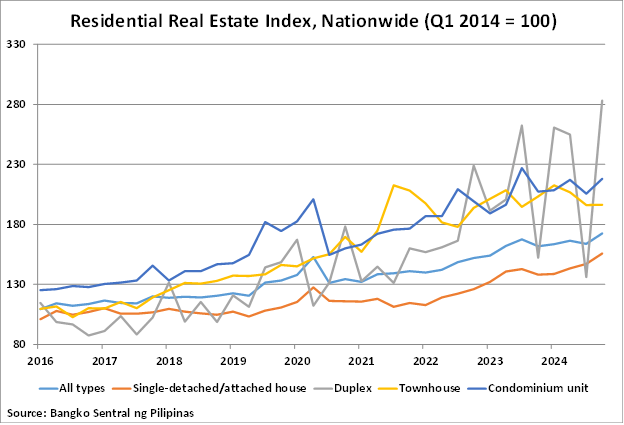

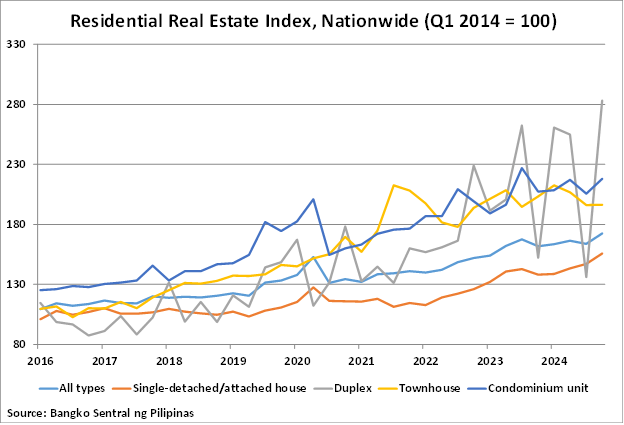

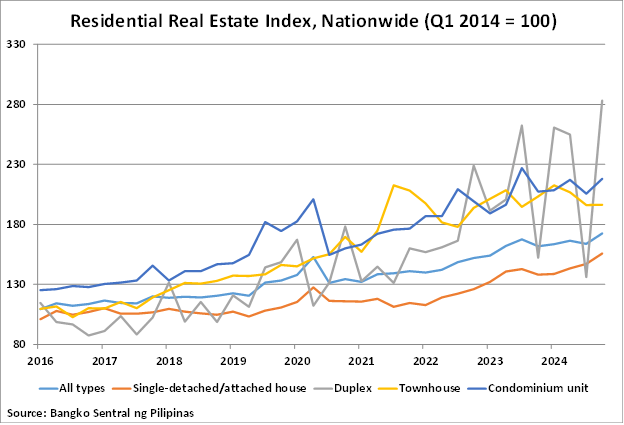

Trends for Residential Real Estate

The residential sector of the real estate industry in the Philippines also possesses an increasing growth of investments as the population continues to grow in the country.

Impact of OFWs Investing into Residential Real Estate

The Philippines is a top recipient of foreign remittances, with OFWs sending over US$2.6 billion in August 2021, up 5.1% from the previous year. This purchasing power drives OFW investment in residential properties, with over 80% planning to invest within a year. Developers offer a variety of homes, from luxury villages to affordable townhouses, to meet their needs.

Rise of Green Spaces

Apart from creating residential and commercial properties, property developers, along with corresponding local government units (LGU), are looking into developing more green spaces in the Philippines.

Developers in Metro Manila are increasingly creating sustainable, eco-friendly office and residential spaces, applying green technology throughout construction and continuing its use in property maintenance. According to Colliers Philippines, around 37% of the building in Metro Manila from 2021 to 2023 are likely to become wellness-certified buildings.

The emergence of Microcities

Microcities combine residential and commercial spaces in one location and provide modern amenities like malls, gyms, groceries, and salons to cater to 21st-century lifestyle needs.

The development targets millennials seeking suitable residential areas, exemplified by microcities like Cebu IT Park in Cebu City.

Invest Into the Real Estate Sector in the Philippines

The Philippines’ strategic location, strong consumer market, and growing economy make it an attractive destination for foreign investors aiming to enter the Asia-Pacific region.